In May of this year, the cryptocurrency market lost $2 trillion in value, leaving many users uncertain about the fate of their funds.

By now, crypto investors are familiar with the fluctuations of the market. There are, of course, massive opportunities for returns with the ability to buy, sell, and trade funds without third-party interference, but cryptocurrency also has its drawbacks in the form of security vulnerabilities. With so many unknowns tied to this relatively new currency (it was first used in 2009), investors and users should stay aware of inherent security risks and the differences in exchange platforms and digital wallets.

Wherever your cryptocurrency lives, it’s important to protect your digital assets from cybercriminals. Here’s what to keep in mind.

Want to make life harder for scammers?

Check out our free username generator and random password generator tools.

Think you have a strong password? Use our password strength tester tool to put it to the test!

Decentralized regulation

Cryptocurrency is not regulated by any government agency, which could make some people hesitant to use it in the first place. While a crypto transaction exists solely online, Bitcoin, Ethereum, and other popular digital currencies have real-world value and can be used to purchase tangible items. Cryptocurrency can also factor into your credit and financial assets: for example, Fidelity investments recently announced that users can put Bitcoin into their 401(k)s.

Cryptocurrency transactions are recorded on a blockchain, which is a digital chain made up of blocks (files) of data. Within each block is a ledger of cryptocurrency transactions with all parties involved. A network of computers verify these transactions, and once complete, the data is immutable. Even though the entire transaction is digital, it can’t be replicated—the resources are finite.

Rather than a single blockchain of data, there are many blockchains, across many networks, all sharing the same information. This limits the ability of one computer or group to regulate or verify all transactions. Instead, the regulation is spread across the various networks.

Peer-to-peer transactions

For many, the idea of peer-to-peer transactions, where two users agree on the exchange and value of an item with no bank interference, is the main appeal of cryptocurrency. Companies have popped up over the years to simplify transactions for users, but in doing so, they take away some of the individual ownership over one’s crypto funds.

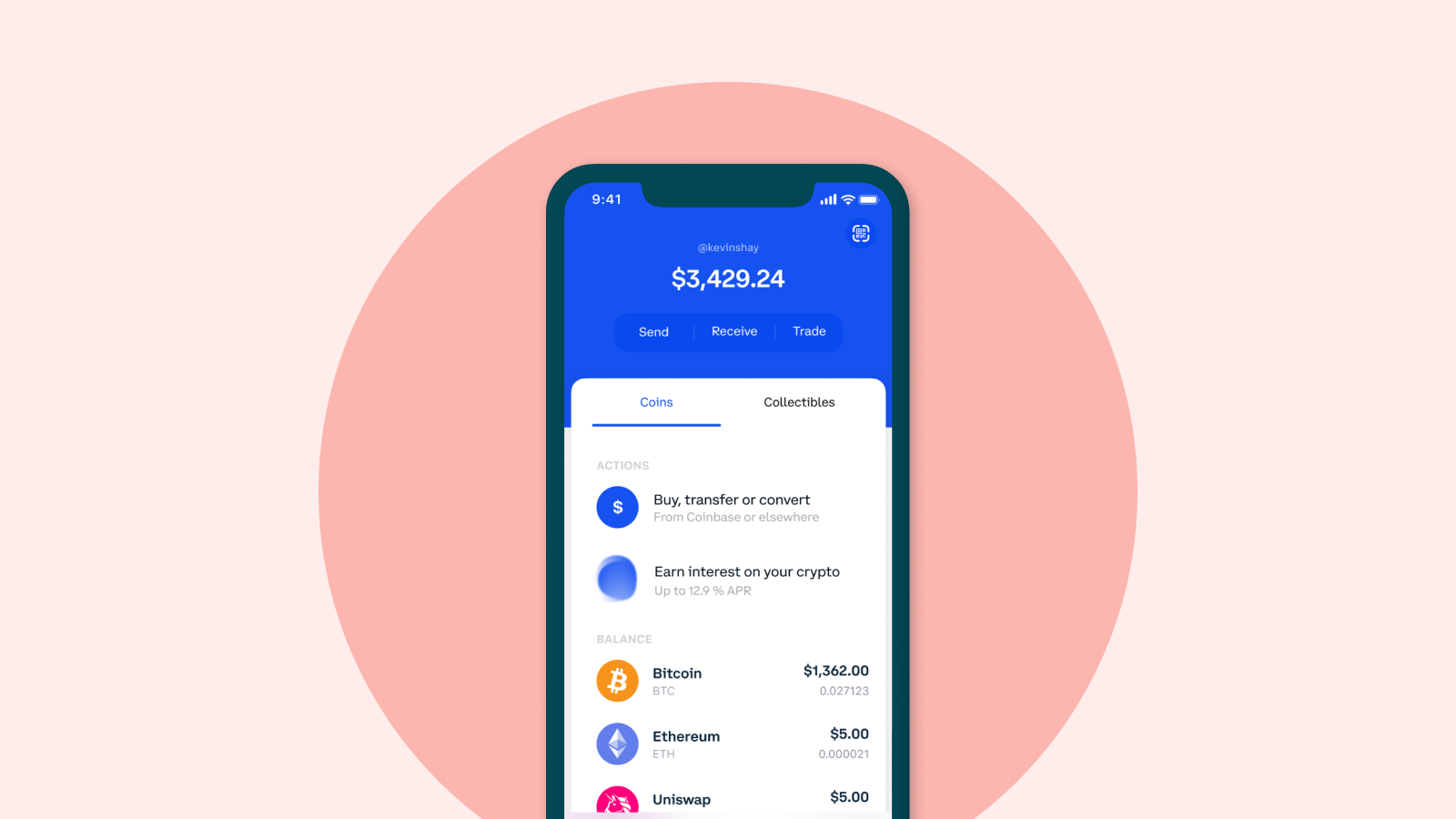

Because of the way certain exchange platforms operate, including Coinbase Global, the largest crypto exchange in the U.S., some users are at risk of losing their data along with their funds. Coinbase reported a $430M quarterly loss and a dropoff in users. If Coinbase declared bankruptcy, users’ assets would be subject to bankruptcy proceedings, meaning users would no longer have access to their funds.

Custodial vs. non-custodial wallets

Coinbase, along with Binance, Kucoin, and Gate.io are all custodial wallets, meaning that they, as a third party, have ownership of your keys, and can control your crypto funds carte blanche.

Having a non-custodial wallet, as with Atomic, Metamask, or Exodus, means you have full control over your funds.

Which is the best option? That depends on your priorities. Custodial wallets are beneficial to beginners who are still getting their feet wet in the crypto market. External transactions to or from a Coinbase account incur a fee, and according to the recent announcement, Coinbase would seize user assets if the company were to go bankrupt.

With a custodial wallet, you create and maintain the keys to your funds, which requires a 12–25 word “seed phrase”—a set of words that grants access to your wallet. This is something you should guard vigilantly to protect your funds.

The risk with a non-custodial wallet is that if you lose your backup phrase, you also lose your funds, and there’s no third party to recover them for you—essentially, you operate as your own bank.

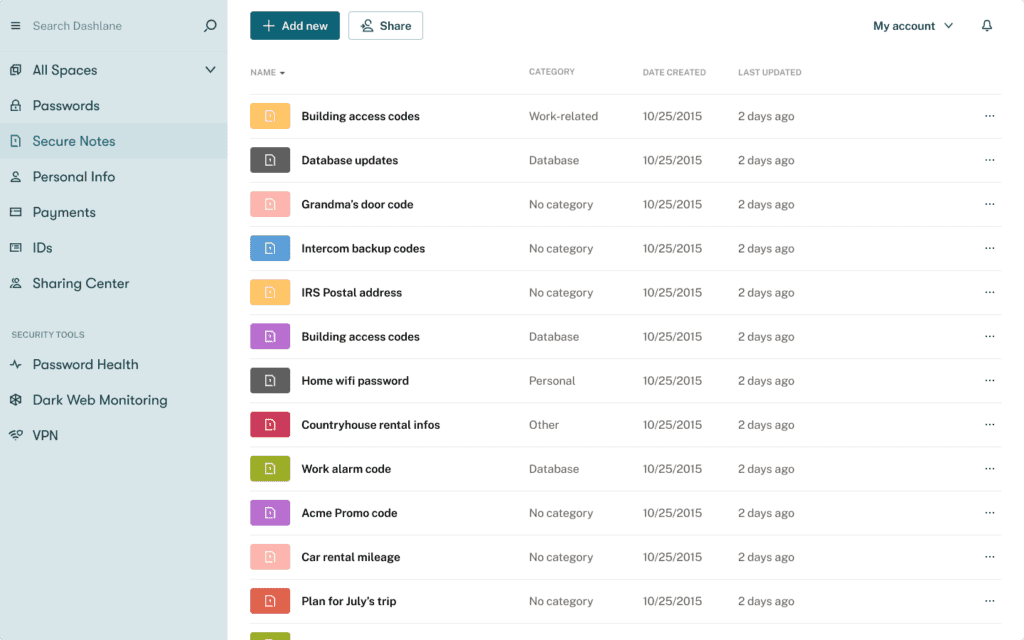

Pro tip: Save your seed phrase in the secure notes of your personal password manager.

Cryptocurrency and threat actors

Digital in nature and with no traditional government regulation, crypto wallets are enticing to hackers.

In fact, crypto is the preferred currency of cybercriminals, and payment is often requested in cryptocurrency during a ransomware attack. Crypto is appealing to cybercriminals because of the ability to quickly move funds. The cyberattack on the Colonial Pipeline demanded ransom in crypto, as did the attack on JBS Foods, the world’s largest meat processor.

Cybercriminals are also likely to go after non-custodial wallets and crypto exchange platforms like Coinbase as those companies have keys to nearly 100 million accounts.

Protecting your digital assets

If you use a non-custodial wallet, meaning there is no third party with keys to your funds, protect your wallet wisely. Do not share your seed phrase with anyone else, and store it in a personal password manager, along with any 2FA codes or passwords associated with your account.

If you use a non-custodial wallet, be sure to read the fine print to know what your rights are should the company be hacked, suffer a data breach, or go bankrupt.

Hackers might also use malware as a means for “cryptojacking,” or essentially hijacking a user’s device for crypto mining to pay themselves. Protect your devices by:

- Using a VPN when you navigate the web

- Being wary of clicking on any potentially malicious links

- Installing antivirus and malware software

- Keeping all software up to date

Stay in the know about Dashlane products and updates and stay on top of your digital safety.

Sign up to receive news and updates about Dashlane

Thanks! You're subscribed. Be on the lookout for updates straight to your inbox.